40.5% Rise In Sharjah’s Real Estate Transactions From January-June 2021

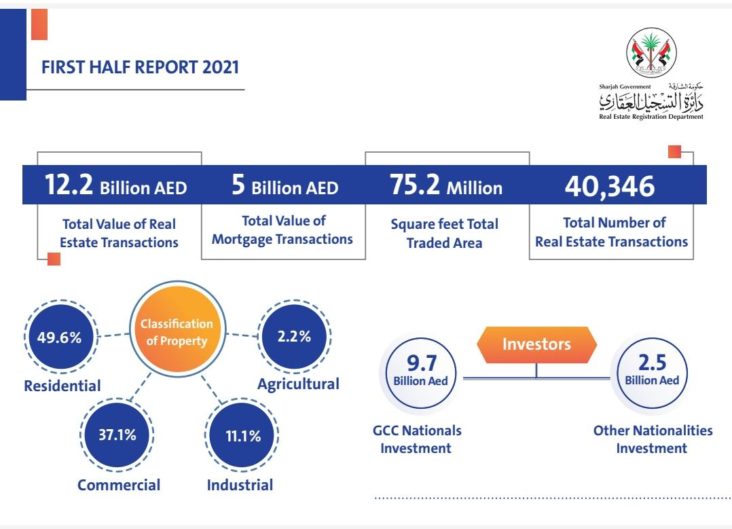

The Sharjah Real Estate Registration Department recorded 40,346 real estate transactions worth AED12.2 billion, marking a 40.5 percent increase till June 2021 against the same period last year, according to the department’s statistical report for the first half of 2021.

Moreover, the total area covered in sales transactions was 75.2 million square feet.

This showed a 96.1 percent increase in transactions as against the same period in 2020, thanks to the return of business after the relative decline of the COVID-19 pandemic. The economic facilitations and incentives launched by the Executive Board in November 2020 increased investors’ confidence in the market. In addition, February witnessed an acquisition worth AED690 million between real estate developers operating in Sharjah for a luxurious residential project.

The department has also provided online services for some transactions, and a pre-appointment reservation system.

Abdulaziz Ahmed Al Shamsi, General Manager of Sharjah Real Estate Registration Department, explained that the department seeks to enhance a competitive business environment, achieve several objectives to encourage investment, and attract new investors from different countries.

There were 25,601 ownership certificate transactions followed by 10,444 ownership deed transactions, with 2,289 initial sales contract transactions. There were 1,457 mortgage transactions, while valuation transactions were 503, and broker’s card transactions came last with 52.

Till June 2021, the emirate recorded 1,457 mortgage transactions worth AED5 billion, a rise of 25 percent as against the same period last year.

Meanwhile, there were 2,863 sales transactions in various regions of the Emirate until June 2021. The largest share was acquired by Sharjah city with 2,546 transactions in 102 areas at a total value of AED4.9 billion.

The leading areas were Al Khan, Al Rigaibah, Hoshi, Al Nahda, and Al Majaz 3, with 1,435 transactions that accounted for 56.4 percent of all transactions. There were 398 transactions in Al Khan, accounting for 15.6 percent of the total in the city.

As for the Central Region, the number of transactions reached 94, worth AED82.3 million, across 28 different areas. These transactions were concentrated in Tayybah 2 and Al Malha, accounting for 29.8 percent of the total sales numbering 28 while the other 66 were distributed in the remaining 26 areas.

The city of Khor Fakkan recorded 77 transactions in 13 areas valued at AED50.4 million. There were 30 transactions in Al Haray industrial area, Al Haray commercial area, and Hayawa, accounting for 39 percent of the total, while the remaining 47 transactions were distributed in 10 areas around Khor Fakkan.

In Kalba city, there were 140 transactions in 20 areas valued at AED76.1 million. There were 84 transactions in the industrial and Al Saaf areas, accounting for 60 percent of the city’s transactions. The remaining 56 were distributed in 18 other areas.

Finally, there were six transactions in the city of Dibba AlHisn worth AED4.1 million. These were distributed in three areas, with the most traded being Al-Shamali Neighbourhood with three, which accounted for 50 percent of the total transactions.

During that period, Sharjah also processed 133 usufruct transactions valued at over AED205 million, led by Muwailih Commercial area with 43, Tilal with 35, and Al Nahda with 32.

Residential transactions accounted for the largest share, with 49.6 percent of the total. Commercial transactions were next with 37.1 percent, followed by industrial transactions at 11.1 percent, while agricultural transactions came in last at 2.2 percent. In terms of the number of transactions by property type, apartments accounted for the largest share, with 711, followed by residential land at 634, and residential built-in land with 559.

Sixty-three nationalities from around the world invested in Sharjah during the first half of 2021, with Gulf Cooperation Council citizens, including those from the UAE, investing a total of AED9.7 billion across 10,787 properties. Investments from other countries, including Arab countries, amounted to AED2.5 billion across 1,961 properties.